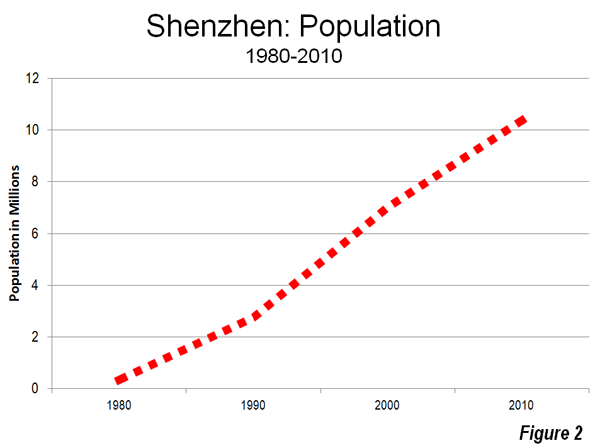

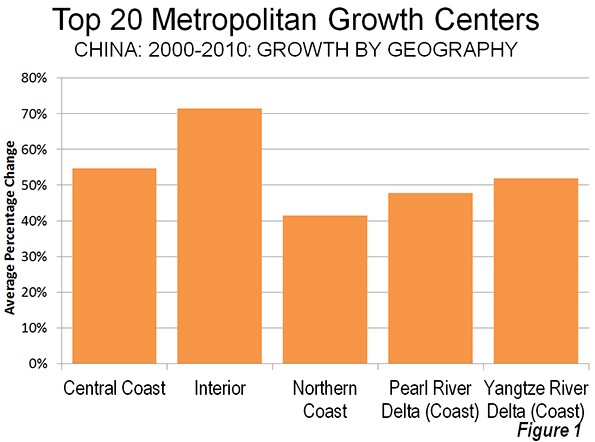

No urban area in history has become so large so quickly than Shenzhen (Note 1). A little more than a fishing village in 1979, by the 2010 census Shenzhen registered 10.4 million inhabitants. It is easily the youngest urban area to have become one of the world's 26 megacities (Figure 1). Most other megacities were the largest urban areas in their nations for centuries (such as London and Paris) and a few for more than a millennium (such as Istanbul and Beijing). Shenzhen’s primitiveness can be seen in this 1980 internet photo, and shows the beginnings of construction. A 2006 photograph of one of Shenzhen's principal streets (Binhe Avenue) is above.

Pearl River Delta Location: Shenzhen is located in Guangdong Province adjacent to Hong Kong's northern border. Shenzhen is China's fourth largest urban area, following Shanghai, Beijing, and Guangzou-Foshan.

Along with Dongguan, Guanzhou, Foshan and smaller neighbors, Shenzhen forms the Pearl River Delta, the world's largest manufacturing center. The Pearl River Delta, along with Hong Kong and Macau, constitutes the world's largest populated extent of urbanization, with nearly 50 million people. They live in a land area of just over 3,000 square kilometers (7,800 square kilometers. By comparison the world's largest urban area, Tokyo-Yokohama, has a population of 37 million and covers 3,300 square miles (8,500 square kilometers). I recall from a Hong Kong to Guangzhou trip on the Canton-Kowloon Railway in 1999 that there was plenty of rural territory on the 100 mile (170 kilometers) route. Today, development takes place along virtually the entire route (Note 2).

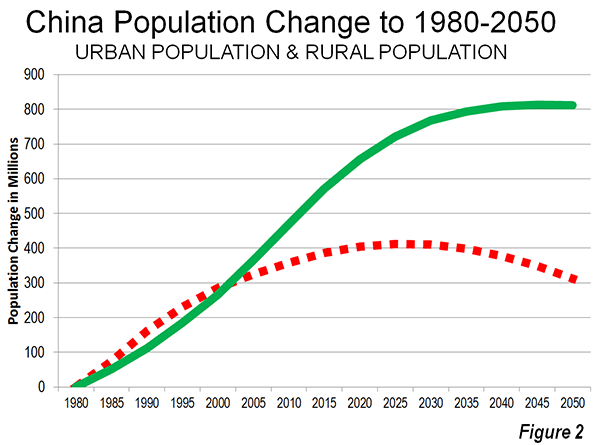

The Special Economic Zone: Shenzhen was established as China's first special economic zone by Deng Xiaoping in the period of liberalization after the death of Mao Zedong. The special economic zones allowed for alternative, generally market oriented reforms, with the end of improving economic growth. The result was economic progress far greater than anyone expected. The special economic zone program was eventually extended to several other urban areas in the nation.

Some governmental officials preferred the previous state dominated approach, despite its greater poverty and sought to roll back the reforms. This threat reached its peak in the early 1990s, after Deng Xiaoping had retired from his government positions. In response, Deng undertook his renown "southern tour" to Shenzhen, Guangzhou and other parts of Guangdong province to promote the new economic approach and the progress that had been made. During the southern tour, Deng is reputed to have said that "to be rich is glorious." Three decades before he had said “I don't care if it's a white cat or a black cat. It's a good cat as long as it catches mice." He committed to results rather than to ideology, in a sense Shenzen and its environs are the engines of non-state owned prosperity. Eventually, the publicity from Deng's southern tour overwhelmed the opposition and China accelerated its move toward a more open economy.

Shenzhen's Core: Unlike the fast growing, but much smaller new urban areas of the United States (for example Phoenix, which is largely a low rise, dispersed expanse of suburbanization), Shenzhen has developed a dense central business district. Even though Shenzhen started the decade of the 1990s with little more than 1,000,000 residents, by 1996 it had the fourth tallest building in the world, the Shun Hing Tower. Only the Sears Tower in Chicago and the two World Trade Center Towers in New York were taller.

In 2011, the Shun Hing Tower lost its local tallest building title to the Kingkey Financial Tower, at 1,449 feet (447 meters) is the 10th tallest building in the world. Now, the world's second tallest building is under construction in Shenzhen, the Ping An International Financial Center, which is reported to reach 2,125 feet or 655 meters, with 116 floors. Only the Burj Khalifa (2,717 feet, 828 meters, 163 floors) in Dubai would be higher. Like Shanghai and Chongqing (and unlike most Chinese urban areas), Shenzhen has a highly concentrated central business district. As a result deserio.com rates Shenzhen's skyline as 9th in the world (Note 3).

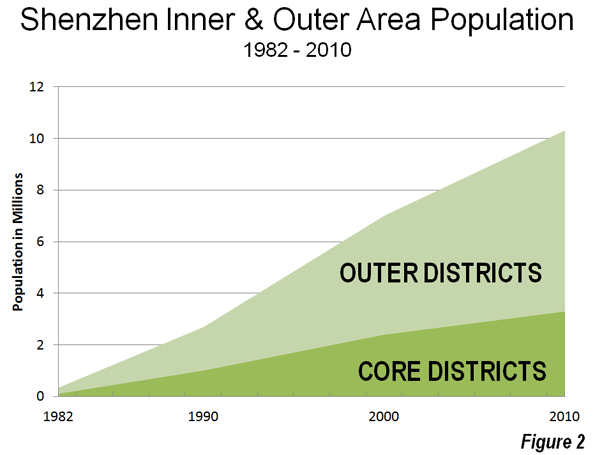

Outer Areas Growing Faster: The three central districts (the qu of Futian, Luohu and Nanshan) grew from 2.4 million to 3.3 million population between 2000 and 2010, a rate of 38 percent. However, as is natural for a growing urban area, most of the growth was in the outer districts (Photo: Suburban Shenzhen), which grew from 4.6 million to 7.0 million, a growth rate of 52 percent. Thus, nearly three-quarters of the growth was on the periphery (Figure 2). Population growth in the earlier 1990 and 2000 period was slightly less concentrated in the outer area (68 percent). But overall population growth has begun to slow down, with Shenzhen added 3.3 million new residents, compared to 4.3 million between 1990 and 2000.

Photo: Suburban Shenzhen (Longgang)

The Urban Area: Overall, it is estimated that the Shenzhen urban area (area of continuous development) has a 2012 population of 11.9 million, with a land area of 675 square miles (1,745 square kilometers). The urban area has now crossed the border into the Huiyang district of the Huizhou region, to the east. The population density is estimated at 17,600 per square mile, or 6,800 per square kilometer, approximately 10 percent less dense than the average urban area in China. Shenzhen is about one quarter the density of Hong Kong and double the density of Paris.

Rich and Poor in Shenzhen: Like all urban areas, Shenzhen is a mixture of rich and poor. Shenzhen is generally considered one of the most affluent urban areas in China, yet it also has a very large low income population. Approximately one-sixth of China's residents are considered to be temporary migrants; many work in boomtowns like Shenzhen. Seven million of these 220 million migrants live in Shenzhen, considered the largest migrant population of any region in the nation. Migrants are attracted to Shenzhen for the same reasons people have moved to cities from early on: to get ahead. At the same time, their remittances sent back home are contributing to improved living conditions far beyond Shenzhen. It is expected that reforms to the "hukou" system of residence permits will allow many of the temporary migrants in Shenzhen and elsewhere obtain permanent residence status. Many of the migrants live in factory housing, or older, very densely packed buildings. At the same time, Shenzhen has a large number of world-class condominium buildings.

Photo: Older Housing: Central Business District

Photo: Newer Housing: Central Business District

The Future of Shenzhen: Much of Shenzhen's future will depend upon the economy of the Pearl River Delta and the extent to which migrants are able to obtain permanent residency status. There is still land enough in the region for substantial population growth. The longer term integration of the Hong Kong and Shenzhen economies could produce an even larger economic dynamo than the two that are currently separate. One thing is certain, however. Shenzhen has led China into a new economic and urban reality.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life”.

-----

Note 1: Shenzhen is one of China's regions, often called "cities," as translated from "shi." "Shi" more resemble regions than "cities" in the non-Chinese sense, this article refers to "shi" as regions. "Shi" were formerly referred to in English as prefectures. A province is usually composed of "shis" and other "shi" level jurisdictions.

Note 2: These combined regions are not a metropolitan area, for two reasons. First; there is little daily commuting between them and thus they are not a single labor market, which is the definition of a metropolitan area. Second, one of the regions, Hong Kong, has a border with Shenzhen that has international style customs and immigrant controls, which further precludes the two adjacent regions from being a single metropolitan area. In the longer run, greater affluence, greater mobility between the regions and relaxation of border controls could merge some or all of the now separate metropolitan areas.

Note 3: Desiro.com, unlike some other skyline rating systems, places a premium on the density of buildings, rather than simply amalgamating building heights from throughout an urban area.

Photo: Shenzhen: Binhe Avenue from the Shun Hing Tower (by author)

a collection of historical travel essays. His next book is Whistle-Stopping America.

a collection of historical travel essays. His next book is Whistle-Stopping America.